Presenting one of the largest inventories of rare coins in the country and three locations for our local collectors.

Most Recent

What’s new at Northern Nevada Coin

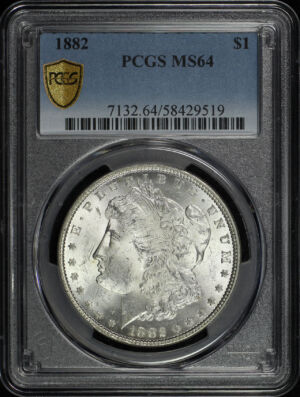

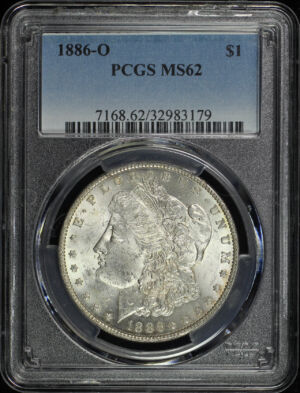

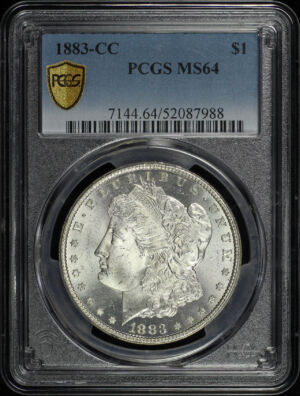

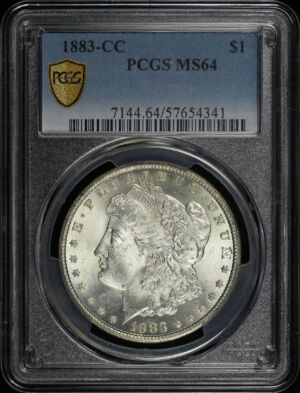

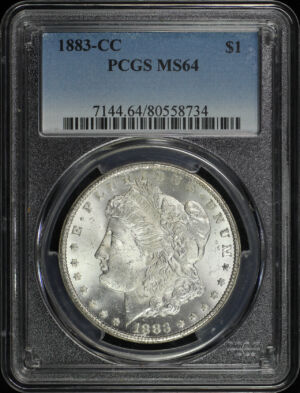

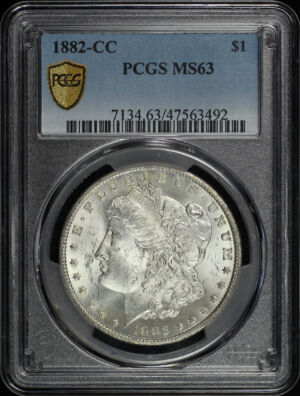

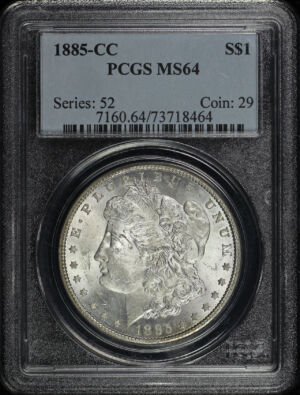

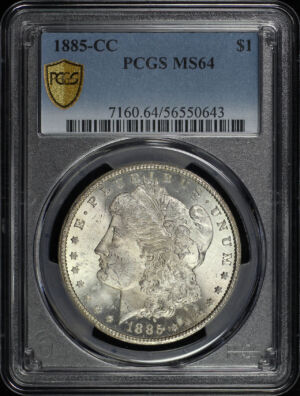

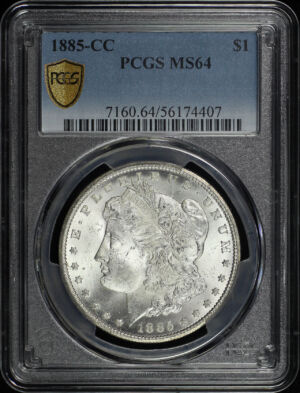

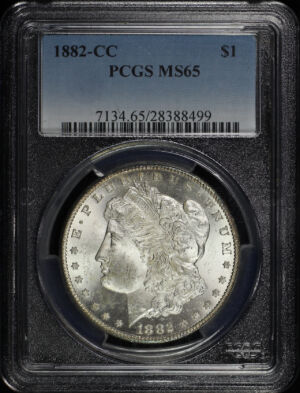

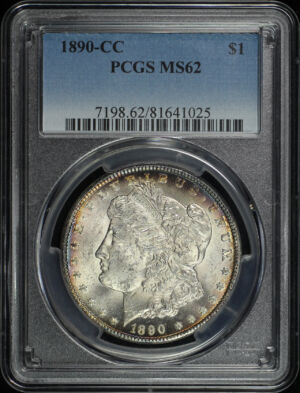

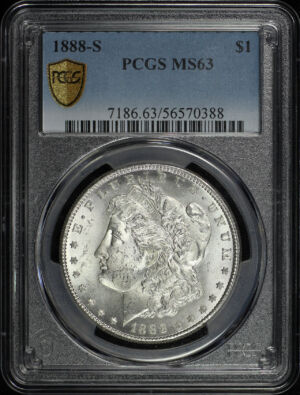

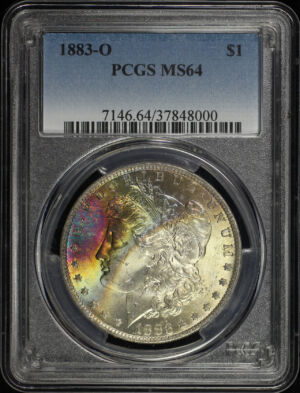

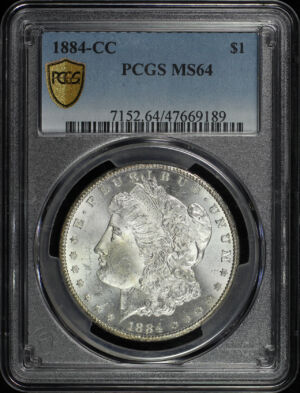

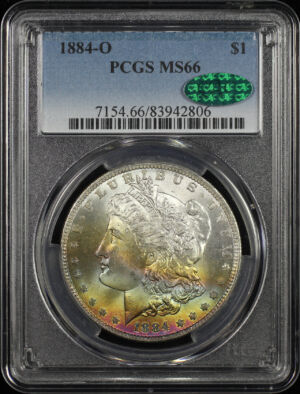

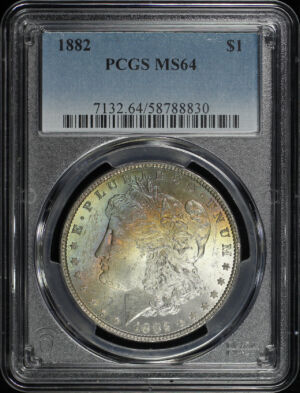

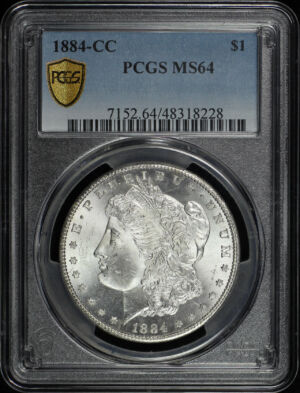

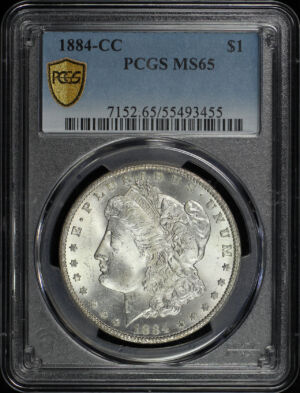

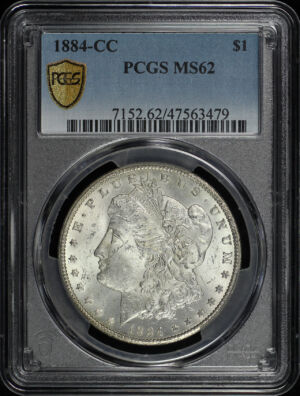

Graded Common-Date Morgan Dollars & Silver Price Volatility

At Northern Nevada Coin, one question we hear more often, especially during periods of rising precious-metal prices, is whether collectible coins move in lockstep with silver. The short answer is: not always, and that can be a good thing.

Consider a familiar example from today’s market.

A common-date 1881-S Morgan Dollar graded MS-63 is currently retailing for around $100.00. When silver was trading near $40.00 per ounce, that same coin typically sold for about $80.00. The spot price of silver has essentially doubled, yet the graded coin’s market price has increased by only about 20%.

This isn’t an anomaly—it’s a reflection of how graded collectible coins behave differently than raw bullion.

The Stabilizing Effect of Grading

Graded coins introduce factors that go beyond metal content alone:

-

Condition certainty: A third-party grade locks in quality and removes some of the guesswork. (Make sure you buy the coin, not the grade.)

-

Established collector demand: Common-date Morgans in popular grades like MS-63 have deep, consistent markets.

-

Finite supply at each grade level: Unlike bullion, you can’t “mint” more MS-63 examples.

-

Historical price structures: Collector coins often move within defined trading ranges over time.

Because of this, graded coins tend to absorb swings in silver prices rather than mirror them. When spot prices spike sharply, bullion reacts immediately. Graded coins, by contrast, often adjust more gradually or sometimes not at all.

Reduced Volatility as a Strategy

For collectors and investors alike, this relative stability can be appealing. While bullion excels at tracking metal prices, graded coins may help smooth out volatility, particularly during periods of rapid market movement.

That doesn’t mean graded coins are immune to change—but their pricing is driven by a broader set of fundamentals than silver alone. Many collectors view them as a hybrid asset: tangible precious metal combined with numismatic demand, history, and conditional rarity.

A Thoughtful Approach to Tangible Assets

Morgan Dollars remain one of the most widely collected and recognized U.S. coins, and common-date, mid-Mint-State examples continue to play a meaningful role in balanced collections.

As markets evolve and metals fluctuate, understanding why certain coins move differently can help collectors make better informed long-term decisions.

Our Website

Enjoy searching one of the country’s most extensive online inventory of rare coins right here on our website. We consider this our fourth store. With stores in Reno, Carson City and Gardnerville you can shop in person or you can shop all three stores at once, including all of our back up boxes, right here online. Of course, if you are in the area our main store is located in historic downtown Carson City and is directly across the street from the Carson City mint. We are just 20 minutes south of Reno and Sparks, and about the same from beautiful Lake Tahoe. We welcome you to visit us and see one of the finest coin shops in the country.

Don’t forget to like us on Facebook!!